Business Meal & Snack Deductions Are Changing in 2026

As part of previously enacted federal tax law, important changes to the deductibility of business meals and workplace food expenses will take effect on January 1, 2026. Because many of these expenses are routine and often overlooked, businesses may wish to plan ahead to avoid unexpected tax consequences.

The most significant change impacts meals and snacks provided at the workplace (i.e., “convenience of the employer” meals). While many of these expenses are currently 50% deductible, they will generally become nondeductible in 2026. This change applies to everyday items many employers don’t think twice about—coffee and drinks in the break room, snacks for employees, food brought in for staff meetings, and meals provided to employees working late—unless an exception applies.

That said, not all meal deductions are going away. Business meals with clients or prospects will remain 50% deductible, as long as you or a company representative are present and business is discussed. For example, taking a client to lunch to review a proposal, meeting a prospective customer over dinner, or grabbing coffee with a vendor to discuss pricing will continue to qualify for a partial deduction.

Meals incurred while traveling for business will also remain 50% deductible in 2026. This includes meals during overnight business trips, airport meals while traveling to conferences, and meals reimbursed using IRS-approved per-diem rates.

There is also good news for employers who host larger employee events. Company-wide social gatherings remain fully deductible even after 2026. Annual holiday parties, company picnics, and office-wide award banquets are still considered 100% deductible expenses, as long as they are offered to all employees and are not primarily for highly-compensated individuals.

Similarly, meals provided to the general public or customers continue to be fully deductible. This applies to situations such as food offered at customer appreciation events, open houses, or product samples made available to the public.

In addition, entertainment expenses—such as sporting events, concerts, or golf outings—remain nondeductible. Food or beverages associated with entertainment may be deductible only if they are purchased separately (or separately stated) and independently satisfy the business-meal requirements.

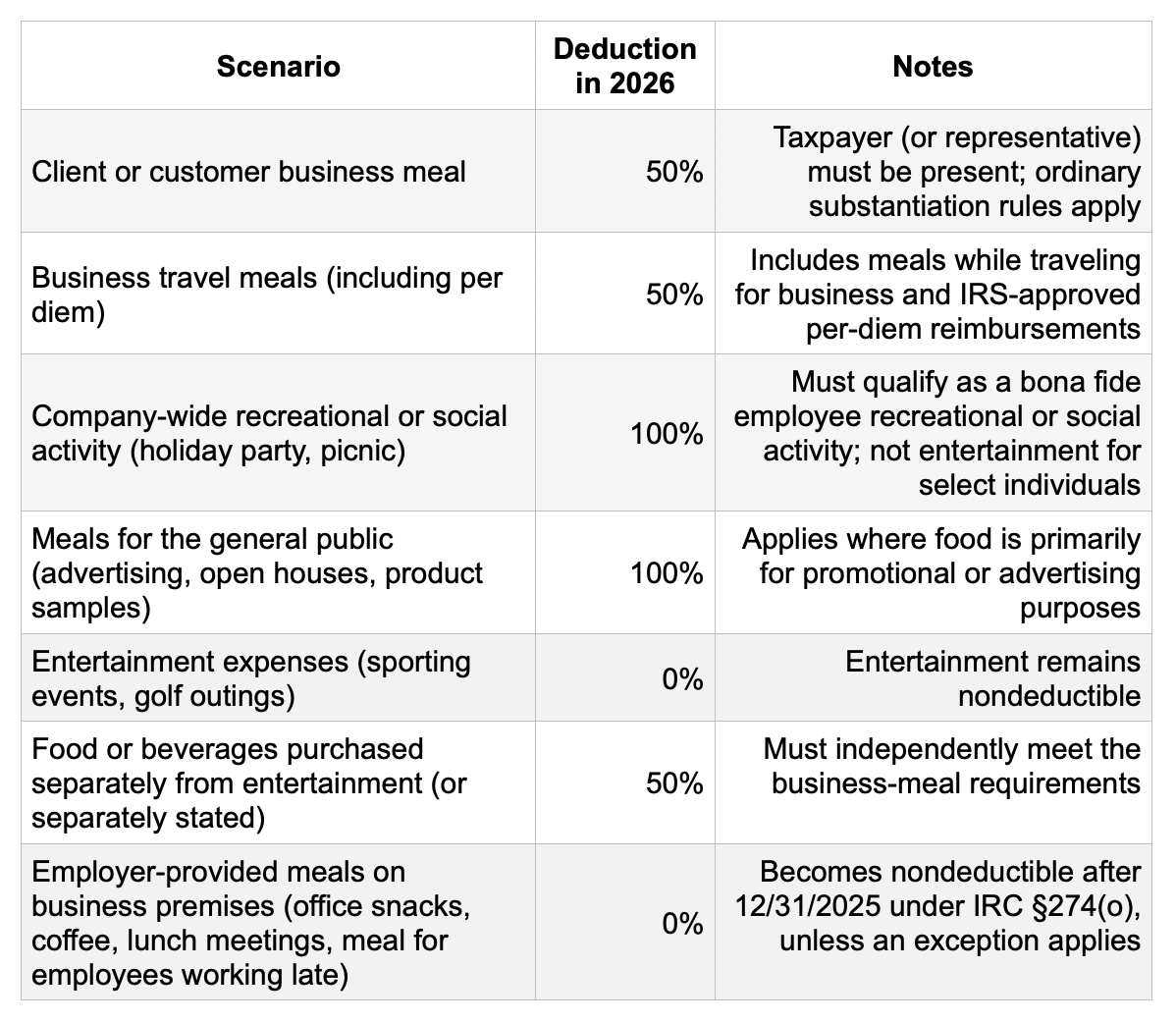

The following is a reference table to summarize the upcoming changes:

With these changes on the horizon, now is a good time for employers to take a closer look at current meal and snack practices. Reviewing budgets, updating internal policies, and ensuring proper documentation will continue to be critical for meals that remain deductible, particularly those involving clients or business travel.

If you have questions about how these changes may affect your business, or would like to discuss planning considerations specific to your operations, please contact Kevin McGrath, Partner and Chair of the firm’s Tax Planning Practice. You can reach Kevin at 215.661.0400 or email him at KMcGrath@HRMML.com.

This Client Alert is being provided for informational purposes only, and is not intended and should not be construed as legal advice.